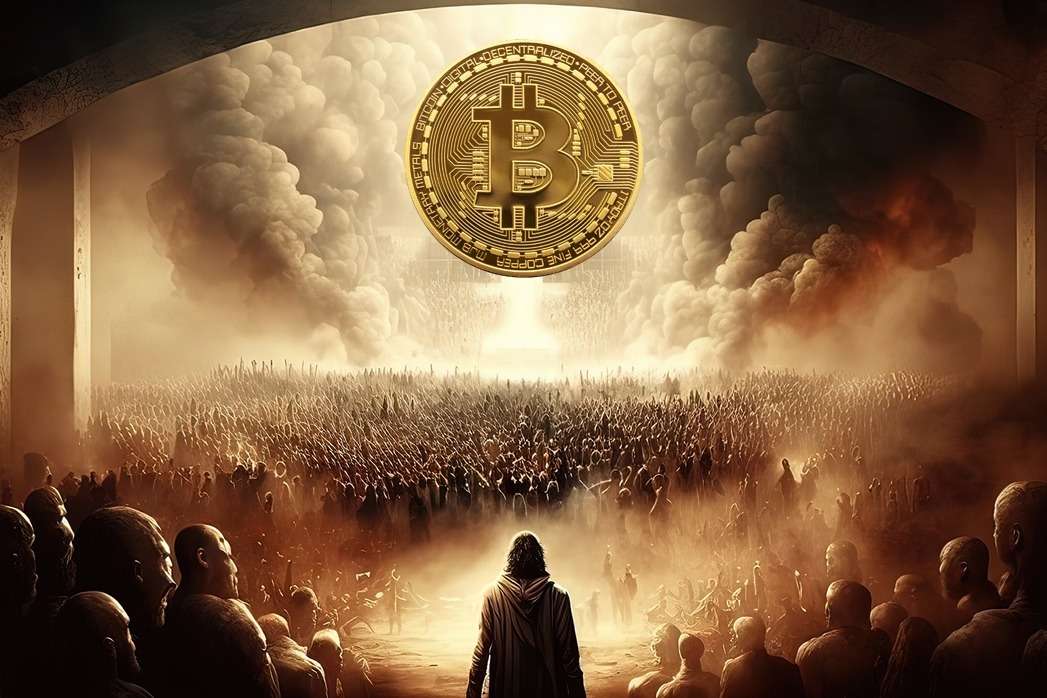

Trading in the Wild West: Why Chasing “Bitcoin Deals” Can Cost You Everything

In every gold rush, more fortunes are lost to shortcuts than to the price of gold.” – DNA Bitcoin Broker Knowledge Base.

Bitcoin’s price continues to rise, institutional demand is exploding, and millions of new investors want exposure.

But where there is hype, there is danger — and in 2025, a new frontier of unregulated Bitcoin trading has emerged: the so-called “Bitcoin deals.”

– High-discount offers.

– Off-market allocations.

– Special bulk pricing.

– Secret OTC sellers.

– Foreign brokers with “inside access.”

It sounds tempting.

In reality, it’s the new Wild West of digital finance, and the risks are far greater than most traders realise.

Learn more:

MiCA & Regulated Digital Assets

The Myth of the “Cheap Bitcoin Deal”

Every week, traders are approached by WhatsApp brokers, Telegram groups, or offshore “liquidity providers” claiming they can sell Bitcoin at a discount.

The pitch is always the same:

- – “We can offer Bitcoin 3–5% below market.”

- – “We have miners selling directly.”

- – “We represent a distressed fund.”

- – “We can bypass exchange fees.”

- – “Minimum transaction: $250k+.”

Here’s the truth:

There are NO genuine discounted Bitcoin deals.

Not from miners.

Not from OTC desks.

Not from international brokers.

Not from “private markets.”

Every professional trader and institution knows this:

Bitcoin is one of the most liquid assets on earth.

There is no such thing as “below market price” — only below market safety.

The Real Risks Behind These Deals

1. Fake wallets and fake escrow

Buyers are often shown blockchain “proof of funds” or “locked wallets.”

In most scams, the wallets don’t belong to the seller, and no Bitcoin will ever move.

2. False OTC desks

Unregulated entities pretend to be licensed trading desks.

They use fake certificates, logos, and even spoofed domain names.

3. Irreversible payments

Victims are pressured into using:

- USDT transfers

- SEPA instant

- Unregulated Stablecoins

- Peer-to-peer remittance systems

Once funds leave, they cannot be recovered.

4. Layered fraud rings

Some operations involve 5–10 intermediaries — all earning “fees” while the buyer receives nothing.

5. No regulatory protection

MiCA now governs digital asset transactions across Europe.

But only regulated entities are covered.

Unlicensed brokers = zero protection, zero legal recourse.

Why Serious Traders Don’t Touch These Deals

Professional traders, funds, family offices, and corporates NEVER buy Bitcoin through:

Why?

Because serious traders prioritise:

- – Liquidity reliability

- – Counterparty risk control

- – Regulatory compliance

- – Transparent execution

- – Proof-of-reserve custody

- – MiCA-compliant settlement methods

“Wild West deals” fail on every point.

The Institutional Standard: Price Isn’t the Risk — Counterparty Is

Banks and regulated brokers don’t compete on discounts.

They compete on:

- – security

- – execution

- – custody

- – reporting

- – compliance

- – insurance

- – liquidity depth

- The premium you think you save in a dodgy deal is nothing compared to the price of:

- – frozen funds

- – lost capital

- – reputational damage

- – regulatory violations

Smart traders don’t look for bargains.

They look for certainty. -

DNA Crypto: Safe, Regulated, Institutional Trading

At DNA Crypto, we provide the infrastructure serious traders rely on:

- – MiCA-aligned execution

- – Deep OTC liquidity at institutional spreads

- – Fully segregated custody accounts

- – Audited proof-of-reserve systems

- – EU-regulated Stablecoin settlements

- – Zero-slippage execution for large blocks

Whether you’re a corporate treasury, HNWI, or active trader, we ensure your purchase is:

Legitimate, compliant, secure, and delivered. - Learn more:

Crypto Custody Solutions -

The Bottom Line

The Wild West era of Bitcoin trading is still alive — and growing.

But today, the stakes are far higher: institutional capital, regulatory enforcement, and market maturity have raised the bar. If someone offers you Bitcoin at a discount, they aren’t offering you an opportunity.

They’re offering you an exit from your own money. In the new era of digital finance, professional traders win not by hunting shortcuts but by operating with clarity, compliance, and credible partners. At DNA Crypto, we ensure you trade with all three. - Image Source: Adobe Stock

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, or investment advice.