“DeFi does not replace traditional finance — it challenges how financial services are delivered and governed.” — DNA Crypto.

In the dynamic world of finance, the emergence of Decentralised Finance (DeFi) poses a significant challenge, disrupting traditional asset management. At this level, investors, financial analysts, and enthusiasts need to understand the distinct domains of DeFi, traditional finance, and conventional finance.

How Does DeFi and Conventional Finance Compare?

In traditional financial management, a manager takes a deep dive into each client’s lifestyle, goals, needs, income, and risk profile to create a personalised investment portfolio that considers growth, revenue, hedging, and liquidity. This portfolio is typically handled by an asset management company and safeguarded by a third-party custodian. Intermediaries are responsible for managing and controlling access to these assets.

On the other hand, DeFi asset management operates on Blockchain technology, known for its rapid evolution, constant development, and high transparency in transactions and holdings. Investors retain complete control over their assets, stored in decentralised protocols or smart contracts, thereby granting them direct access without intermediaries.

Traditional asset management, a tightly regulated industry, prides itself on established security measures and offers insured and protected assets. In contrast, DeFi operates in a changing regulatory landscape and faces risks associated with vulnerabilities in smart contracts. Insurance options within DeFi are also somewhat limited.

DeFi vs. Traditional Asset Management: A Comparative Outlook

Ostensibly, traditional asset management may face liquidity challenges and is subject to geographic, political, and financial entry barriers, with flexibility somewhat restricted. In DeFi asset management, liquidity and accessibility are prominent, featuring instant transactions, global reach, and minimal entry barriers. Moreover, it introduces innovative financial products.

DeFi asset management generally incurs lower fees due to the absence of intermediaries, though blockchain transaction costs remain. In contrast, traditional asset management incurs higher fees due to multiple intermediaries and administrative and management expenses.

Talk of autonomy, rapid innovation, and transparency in DeFi asset management, but it comes with regulatory uncertainties and security risks. While traditional asset management provides a foundation of security, regulation, and established infrastructure, it may lack the same level of innovation and transparency as DeFi. As an investor, you are encouraged to assess your risk tolerance, investment goals, and the evolving landscape of both sectors before selecting an asset management approach.

One may wonder about the advantages of both. DeFi Asset Management offers notable benefits such as transparency, composability, and a trustless, global digital infrastructure. These DeFi Asset Management platforms aren’t just for the big shots – they serve millions of investors, even those who might never have considered investing because they didn’t have enough cash to cover fees or live in places with shaky financial systems.

And get this, some of these DeFi Asset Management setups are like your dream-come-true kind of deal. You can set goals, hit deposit, and practically forget about it. No need to stress about what’s happening with the assets or protocols in the background. It’s like a set-it-and-forget-it magic trick for your investments.

Defi Asset Management Platforms

– DeFi Saver

– dHEDGE

– Set Protocol

– Port Finance

– Range Protocol

– Zerion

– Zapper

– Balancer

– Synthetix

– Yearn Finance

Complexity of Managing DeFi Portfolios

DeFi is a complex world with numerous protocols and applications, which consequently makes it hard for users to manage their portfolios effectively. However, DeFi asset management companies simplify portfolios, helping users make better investment decisions.

Risk Management of DeFi Investments

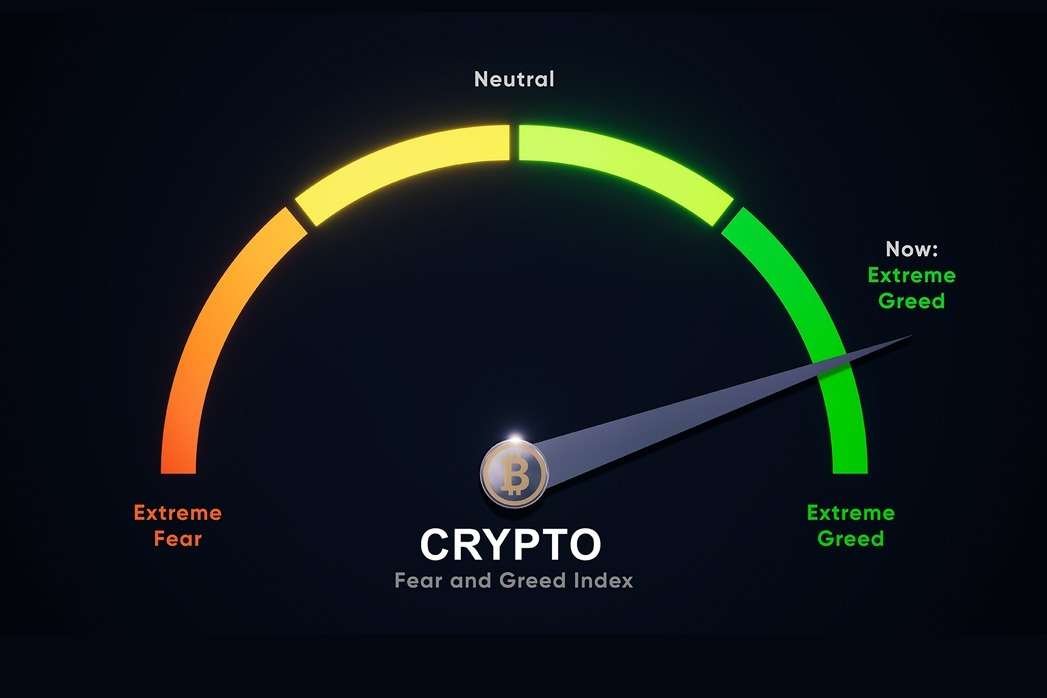

DeFi investments carry risks, including smart contract vulnerabilities and market volatility. DeFi asset management companies help users manage these risks by developing and implementing strategies.

Lack of Access to Professional DeFi Asset Management

Traditional asset management firms are slow to embrace DeFi, resulting in limited access to professional DeFi asset management services. DeFi asset management companies offer users tailored access to professional services within the DeFi ecosystem.

Time-Consuming DeFi Research and Analysis

Keeping up with the rapidly evolving DeFi landscape can be time-consuming. DeFi asset management companies mitigate this burden by researching DeFi protocols and applications.

Difficulty in Keeping Up with the Rapidly Evolving DeFi Landscape

Given the dynamic nature of DeFi, with new protocols and applications constantly emerging, it can be challenging for users to keep track. DeFi asset management companies remain current with the latest developments, helping users navigate the ever-evolving DeFi space.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.