The Truth About Bitcoin: Why Crypto Isn’t a Ponzi — It’s the Future of Finance

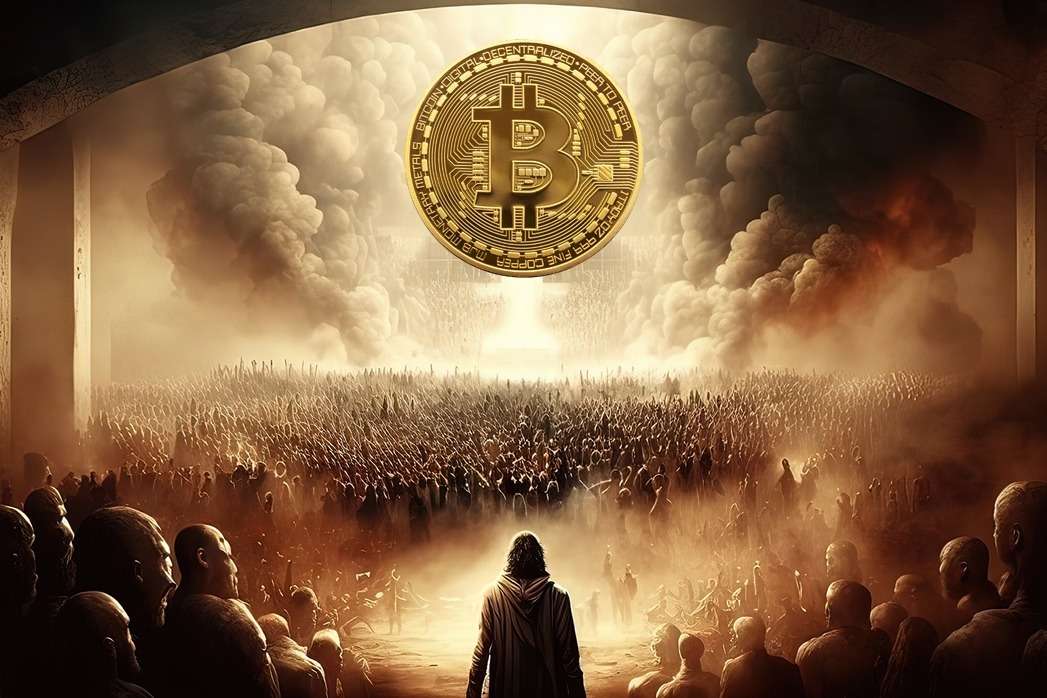

“Every revolution looks like a scam to those benefiting from the status quo.” – DNA Crypto Knowledge Base.

For years, critics have called Bitcoin a Ponzi scheme, a bubble, or a get-rich-quick fantasy.

And yet, seventeen years after Satoshi Nakamoto’s whitepaper, Bitcoin has outlasted banks, bankrupt exchanges, and billions in scepticism — emerging as one of the most resilient financial systems ever created.

In 2025, it’s clear: Bitcoin isn’t the scam.

The real deception was believing that inflationary money and opaque banking systems could last forever.

Learn more: What Is Bitcoin and Why It Matters

Myth #1: “Bitcoin Is a Ponzi Scheme”

A Ponzi scheme requires a central operator who pays returns to early investors using funds from new ones.

Bitcoin has none.

There’s no central authority, no guaranteed returns, and no entity controlling issuance.

Bitcoin runs on open-source code and decentralised consensus — anyone can verify every transaction since 2009.

If Bitcoin were a Ponzi, it would be the only transparent one in history — with public ledgers, open audits, and predictable issuance.

The real unsustainable system?

Fiat currencies are inflated by governments that print money at will, devaluing savings to sustain debt.

Myth #2: “Bitcoin Has No Intrinsic Value”

The same was once said about the internet, email, and gold.

Bitcoin’s value isn’t physical — it’s mathematical.

It represents digital scarcity, global liquidity, and programmable ownership.

In 2025:

-

– Bitcoin’s market capitalization exceeds $1.6 trillion, surpassing silver.

-

– More than 200 million wallets hold Bitcoin globally.

-

– Institutional holdings account for 14% of the total supply.

-

– ETF inflows now exceed $65 billion.

Value in finance is trust — and Bitcoin is the first asset to prove trust mathematically rather than demand it institutionally.

Explore: Bitcoin Market Dynamics

Myth #3: “Crypto Is Only for Criminals”

This narrative has been disproven again and again.

In 2025, less than 0.34% of blockchain activity is linked to illicit use, according to Chainalysis.

By contrast, over $2 trillion in annual banking transactions involve money laundering, fraud, or tax evasion in traditional systems.

The truth is that crypto exposes crime — every transaction is traceable, every movement permanent, every record immutable.

Criminals prefer cash. Innovators prefer code.

Learn more: DeFi and MiCA Regulation.

Myth #4: “Bitcoin Will Go to Zero”

This prediction has been made more than 450 times since 2010.

And yet, Bitcoin has survived every bear market, every ban, every headline — because it’s not a company, a stock, or a government project.

It’s a global monetary protocol, supported by miners, developers, and users in 190+ countries.

In 2025, central banks are studying Bitcoin’s design as they develop their own digital currencies (CBDCs).

Far from dying, Bitcoin has become the benchmark of sound money in an age of infinite printing.

The Real Ponzi: Fiat Economics

The irony?

The systems calling Bitcoin a Ponzi are the ones borrowing from the future to fund the present.

Global debt has reached $320 trillion.

Currencies lose purchasing power yearly, while central banks rely on money creation to sustain short-term growth.

Bitcoin fixes this by design:

-

– Supply capped at 21 million coins.

-

– Issuance halves every four years.

-

– Validation distributed globally.

It’s not a Ponzi — it’s the antidote to one.

See: Institutional Bitcoin Adoption

DNA Crypto: Education Over Speculation

At DNA Crypto, we believe truth outlasts trends.

Our mission is to help institutions, corporates, and investors understand Bitcoin and digital assets — not as hype, but as the next chapter of global finance.

We deliver:

-

– MiCA-aligned brokerage and custody

-

– Market intelligence and advisory

-

– Educational content for institutional onboarding

-

– Secure, transparent access to the digital asset economy

Because the future of money shouldn’t be built on mystery — it should be built on mathematics, regulation, and integrity.

Learn more: Crypto Custody Solutions

The Bottom Line

Bitcoin isn’t a Ponzi.

It’s a revolution in truth, transparency, and accountability — the values the old system forgot.

As regulation brings clarity and institutions embrace digital assets, one thing is sure:

Crypto’s future won’t be built by hype — it’ll be built by those who understand its purpose.

At DNA Crypto, that purpose is simple: to make the future of money real.

Image Source: Adobe Stock

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, or investment advice.