Simply put, tokenization is like giving sensitive data a secret identity by swapping it with special codes. These codes still carry all the essential details but without putting the data at risk.

Small and midsize businesses are embracing Tokenization to increase security in credit card and online transactions. It’s a smart move that safeguards sensitive information and reduces the hassle and expenses associated with following industry rules and government regulations.

What Does Tokenization Entail?

Tokenization technology is broad, extending from protective mechanisms to various types of sensitive data and from bank transactions and medical records to criminal histories, driver information, loan applications, stock trading, and voter registration, asserting its versatile nature.

Typically, any system that can use a non-sensitive proxy to stand in for sensitive details stands to benefit from Tokenization.

Vis-à-vis payment processing, Tokenisation safeguards credit card data and other sensitive information. It’s the silent protector for various scenarios, including mobile wallets like:

- – Google Pay and Apple Pay.

- – E-commerce platforms.

- – Businesses securely hold onto customers’ card details.

With Tokenization, these applications protect sensitive data from threats and unforeseen breaches.

How Tokenization Works

Tokenization is like a digital disguise for sensitive information, where the actual details are swapped with substitute data known as a token that comes to life in different modes:

- Reversible Encryption: Think of it like a secret code that can be cracked with the right key.

- Non-reversible Functions: This is more like a one-way street, using functions like hash functions that don’t go backwards.

- Index Functions or Random Numbers: Tokens can also be born from these methods.

Now, the token becomes the public face of the information, while the sensitive details it represents are kept in a central server called a token vault, where the original info can be reconnected with its token companion.

History of Tokenization

Tokenization isn’t a new concept – it’s been around since the early days of fiat currencies. Please think of the coin tokens people used back when they replaced actual coins and bills. You’ve probably seen it with subway tokens or in the glittery world of casinos, where they stand for real cash. It’s the same idea, whether we’re talking about physical tokens or their digital counterparts – they’re standing in for something more precious.

Now, Tokenization’s digital side made its debut in the 1970s. Back then, it was a neat trick to keep sensitive data separate from the rest in the databases of the time.

Fast-forward to more recent times, and Tokenization has become integrated into the card payment industry. It stepped in as the superhero to shield highly sensitive cardholder data and adhere to the industry’s rules. A group called TrustCommerce is the brains behind the concept, introducing tokenization in 2001 to keep payment card information safe and secure.

Types of Tokens

According to the SEC, there exist three main types of tokens:

- Asset/Security Tokens: These are like financial whiz-kids, offering a promise of profit. Think of them as the economic counterparts of bonds and stocks.

- Utility Token: Now, these tokens are multitaskers. They’re not just about paying the bills; they can unlock access to a product or platform or snag you a discount on future goodies and services. They add extra value to how things work.

- Currency/Payment Token: These tokens are born to be spenders. They exist to be the money in transactions for stuff outside the platform they call home.

And when it comes to payments, there’s a tremendous difference between high-value tokens and their low-value counterparts. This came when the FCA in the UK recently approved using tokenized shares for investment purposes.

The Perks of Tokenization

Why is Tokenization the cool kid on the block? Well, here’s the lowdown:

- Friendlier with Legacy Systems: Unlike encryption, Tokenization plays nice with the older systems-no need for a tech overhaul.

- Light on Resources: Tokenization doesn’t hog resources like encryption does. It’s like going for a jog instead of lifting weights.

- Less Fallout in a Breach: If the worst happens and there’s a data breach, Tokenization minimises the mess: less damage control and more peace of mind.

- Boosts Convenience in Payments: Tokenisation is the driving force behind innovations like mobile wallets, one-click payments, and more, even dipping its toes into the world of cryptocurrency. Customers and investors love it because it’s both secure and convenient.

- PCI DSS Compliance Made Easier: Dealing with PCI DSS regulations becomes simpler for merchants. Tokenization streamlines the process, making everyone’s life easier.

Tokenization and PCI DSS

The Payment Card Industry (PCI) rules are clear: no credit card numbers should be stored on those point-of-sale terminals or in the merchant’s databases once the customer completes their transaction.

So, if a merchant wants to play by the rules and be PCI-compliant, they have a couple of options. One, they can invest in sophisticated end-to-end encryption systems. Two, they can take the easier route and hand over their payment processing to a service provider that incorporates tokenization into the mix. That way, the service provider ensures the cardholder data remains secure.

Tokenization and Blockchain

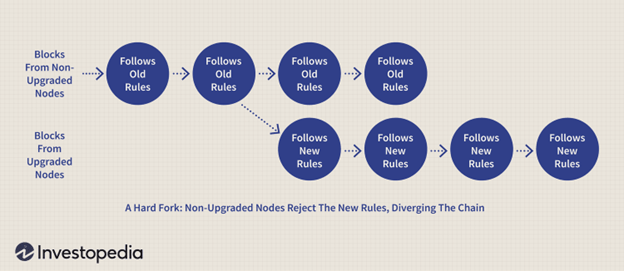

In the blockchain world, tokenization refers to converting real-world assets into digital tokens, also known as security or asset tokens. These tokens represent physical assets, such as property or currency, in a digital form.

Unlike the traditional approach, where big banks kept track of transactions, blockchain empowers individuals. People using cryptography, rather than a significant central authority, confirm the integrity of each transaction.

How does it work? All these cryptocurrency tokens are connected to a blockchain, a digital ledger of transactions. This chain creates an unchangeable record of transactions, with each new set (or block) depending on the previous ones for verification.

The cool part is that authorised individuals can trace a tokenised asset in the blockchain back to the real-world asset it represents. And all this happens securely because every block in the chain has to make sense. It’s like a digital paper trail that keeps everything in check.

Image stock: Adobe Stock

Disclaimer: This article is provided for informational purposes only. It is not intended to be used as legal, tax, investment, financial, or other professional advice.