The Luxury of Privacy: Zero-Knowledge Proofs and Tiered Access in OTC Crypto Markets

High-net-worth individuals (HNWIs), institutional investors, and sophisticated organizations increasingly demand discretion in financial transactions. Yet in crypto markets—where transparency is the default—achieving both privacy and compliance remains a persistent challenge.

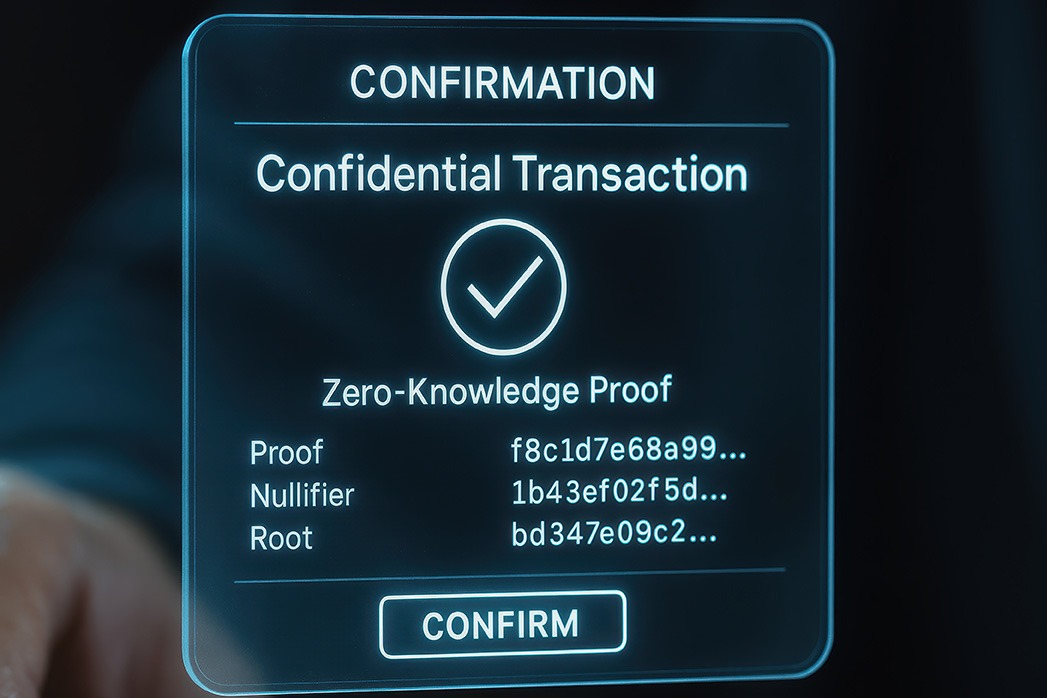

This is where zero-knowledge proofs (ZKPs) and tiered access models come into play.

What Are Zero-Knowledge Proofs (ZKPs)?

ZKPs are cryptographic techniques that enable one party (the prover) to verify the truth of a statement to another party (the verifier) without revealing the underlying data.

In practical terms:

-

– Prove your identity without sharing your passport.

-

– Verify investor accreditation without disclosing your net worth.

-

– Demonstrate AML/KYC compliance without exposing your full transaction history.

“ZKPs prove a statement without revealing the actual information behind it, making them ideal for financial applications requiring both compliance and confidentiality.”

— Zero-Knowledge Proofs: The Privacy Backbone of Digital Identity

Why Privacy Matters in OTC Crypto Deals

Over-the-counter (OTC) crypto trading involves large, negotiated transactions—often in tokenized real estate or other high-value assets—executed off-exchange. Confidentiality in these deals helps:

-

– Mitigate reputational risk.

-

– Protect wealth, privacy, and strategic business data.

-

– Prevent front-running and price slippage.

Yet, regulators require identity verification and auditability. The key is enabling oversight without overexposure.

MiCA, KYC, and the Case for Zero-Knowledge Compliance

The EU’s Markets in Crypto-Assets Regulation (MiCA) imposes strict requirements on crypto asset service providers (CASPs), reinforced by the Transfer of Funds Regulation (TFR) and Travel Rule. These require identity data for transactions over certain thresholds.

“ZK technology offers a way to share only the necessary data for compliance—no more, no less.”

— Zero-Knowledge Compliance: The Future of KYC in DeFi

ZKPs help bridge this gap by enabling selective disclosure.

Use cases include:

-

– Proving AML-screened status without exposing the full transaction graph.

-

– Verifying wallet control without revealing behavioural patterns.

-

– Providing regulators with audit trails on a strict need-to-know basis.

Tiered Access Models: Who Sees What—and When

A single-level permission model is not suitable for high-stakes deals. Tiered access systems, powered by ZK credentials, provide differentiated transparency based on verified roles.

Example tiers:

-

-Public: General offer summaries only.

-

– Accredited Investors: Full deal data upon ZK verification.

-

– Institutional: Full access post-NDA and advanced credential checks.

“We believe access control isn’t just about compliance—it’s about building trust while respecting data boundaries.”

— Confidential OTC Markets: Tiered Access and ZK Credentials

This framework supports:

-

– Luxury real estate tokenization.

-

– Institutional OTC desks.

-

– Private DeFi vaults and DAOs.

Privacy Technologies in Action

DNA Crypto and its partners are already integrating real-world ZKP solutions into financial infrastructure:

-

– zk-SNARKs: Succinct, non-interactive proofs.

-

– zk-ID frameworks: Privacy-preserving identity layers.

-

– Decentralized Identifiers (DIDs): Self-sovereign login systems.

-

– Private smart contracts: Logic execution without public data exposure.

“Confidentiality doesn’t mean opacity—it means precision.”

— Private Smart Contracts: How They Work in Web3

Premium Privacy, Compliant by Design

Post-MiCA, compliance is non-negotiable—but that doesn’t mean discretion must be sacrificed. With ZKPs and tiered access, platforms like DNA Crypto can offer:

-

– Cryptographic audit logs, not open ledgers.

-

– “KYC-once, prove-anywhere” frameworks.

-

– Private participation in sensitive, high-value deals.– Role-based permissions that evolve with user verification.

Final Thought: Privacy as a Luxury—and a Right

In regulated crypto markets, privacy isn’t just an ethical stance—it’s a strategic necessity. Investors aren’t seeking anonymity. They want assurance that their sensitive data is shielded while remaining compliant.

ZKPs and tiered access models create a new gold standard: access verified, compliance fulfilled, privacy preserved.

This is not just the future of investing—it’s the luxury of privacy.

Image credit: Adobe Stock

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, investment, or financial advice.