“Hard forks reveal who truly governs a blockchain — code, miners, or consensus.” — DNA Crypto.

In the context of blockchain technology, a hard fork is a significant protocol change that can result in the validation of previously deemed invalid blocks and transactions, or the opposite. This type of fork requires all nodes or users to upgrade their protocol software to the most recent version.

Hard forks typically originate from developers or a cryptocurrency community that is not satisfied with the features provided by current blockchain implementations. Additionally, they emerge as a means to secure funding for new technology projects or cryptocurrency ventures.

Understanding a Hard Fork

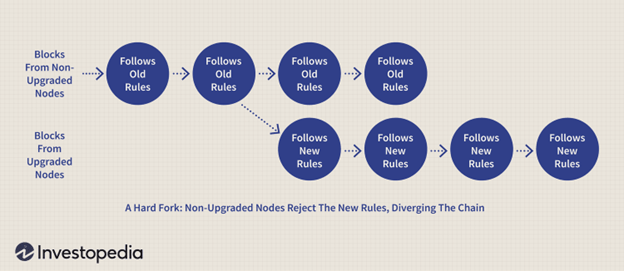

A hard fork occurs when two competing, incompatible updates to a blockchain occur. The winning update creates a permanent divergence from the previous blockchain version.

The introduction of a new rule in the codebase triggers a fascinating phenomenon in the blockchain: a fork. This fork presents two distinct paths—the first follows the upgraded and refined blockchain, while the second continues along the established route. Over time, participants on the older chain realise that their blockchain version is outdated or insignificant. Consequently, they swiftly upgrade to the latest version, aligning with the blockchain’s evolution.

How do Forks Work?

Cryptocurrencies other than Bitcoin are also vulnerable to blockchain forks. This is because all blockchains operate in much the same way, regardless of the platform they run on. You might think of blocks in a blockchain as cryptographic keys that move memory. Because miners in a blockchain set the rules for moving memory within the network, they understand those rules when they are implemented.

To change the rules governing a blockchain, all miners must reach consensus on the new regulations and the definition of a valid block in the chain. This necessitates a “forking” process, analogous to a road split, indicating a protocol shift or diversion. Subsequently, miners update the software to align with the newly established rules.

This forking process has led to the creation of various digital currencies that resemble Bitcoin, such as Bitcoin Cash, Bitcoin Gold, and others. For casual cryptocurrency investors, distinguishing between these cryptocurrencies and tracking the timeline of their respective forks can be tricky.

Moreover, individuals seeking to engage with the top cryptocurrency exchanges must exercise caution when investing in cryptocurrencies such as Bitcoin, as it is crucial to avoid wasting time and money on the wrong digital currency.

Hard Fork vs. Soft Fork

While an older code version for a cryptocurrency platform remains on the network, a new one is generated. Ideally, hard and soft forks are fundamentally similar.

With a soft fork, once a user accepts an update, only one blockchain will remain valid. With a soft fork, the old and new blockchains coexist, requiring software updates to conform to the new rules. While a hard fork produces two blockchains, a soft fork is intended to yield only one; both result in a split.

Most users and developers advocate a hard fork, even when a soft fork appears to be a better option, because of the security implications of hard versus soft forks. While updating a blockchain’s blocks requires significant computational resources, a hard fork to enhance privacy is preferable to a soft fork.

Image Source: Adobe Stock

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.