The fourth Bitcoin (BTC) halving is now done and dusted. What next? Industry experts are predicting an upcoming price surge. This has created an intense sense of enthusiasm in the crypto sphere about what lies ahead. This is especially true after considering the slashed inflation rate and an increase in the scarcity of Bitcoin.

The Impact of Bitcoin Halving on Value and Mining Profitability

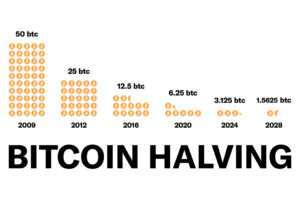

The Bitcoin halving is a pre-programmed event that halves the reward miners receive for validating new transactions and adding them to the Blockchain. Sequentially, the reward for miners is on the diminishing end, effectively increasing Bitcoin’s value as each digital coin becomes rarer.

If demand for Bitcoin remains steady or increases, its price is likely to rise. Investors can look forward to potential gains over the year. This increase is significant for making mining profitable, which will ensure that the transaction-processing system remains robust.

Cathie Wood’s Bold Predictions for Bitcoin’s Future

Bitcoin, the leading Cryptocurrency, continues to be an attractive entry point for new Crypto enthusiasts. Cathie Wood of ARK Invest is on record saying that the inflation effects are due to these halving cycles coupled with the emergence of spot Bitcoin exchange-traded funds (ETFs), which could catapult Bitcoin’s price to $1.5 million (£1.1 million) by 2030.

It does not stop there. She anticipates a more aggressive Bitcoin acceptance in the financial sector, which could see its value skyrocket to $3.8 million (£2.9 million). One may wonder just how much traditional financial institutions adapt to new technology. But again, Bitcoin isn’t the only Cryptocurrency. Other stellar players like Ethereum (ETH) and Polkadot (DOT) are fast becoming investor favourites.

Ethereum and Polkadot: Rising Stars in the Crypto Ecosystem

Polkadot (DOT) is a multi-chain protocol that, furthermore, enables cross-blockchain transfers of tokens and any data or assets. Additionally, this interoperability aims to create a fully decentralised and private web controlled by its users while also simplifying the creation of new applications, institutions, and services.

Similarly, Ethereum is frequently mentioned in the same breath as Bitcoin, with its price-pegged movements. This connection can largely be attributed to market sentiments towards Bitcoin’s formidable influence in the crypto space, which, in turn, enables Ethereum to benefit from the spotlight as well.

In its entirety, Ethereum’s innovative smart contract technology adds value to the Crypto market. The network’s capacity to accommodate numerous ERC20 tokens grants it a significant role in the digital currency ecosystem. It goes a long way to justify its long-term gains as compared to Bitcoin’s more simplistic value-storage proposition. The rising development activity in apps and programs based on smart contracts, along with all the attention surrounding Cryptocurrency, suggests a bright future for Ethereum.

Nonetheless, Ethereum is not without its challenges. We also have Solana (SOL) and Cardano (ADA), which offer faster and arguably more efficient services. Such competition is indicative of the dynamic and fast-paced nature of the crypto sector, which continues to demand innovation and adaptability.

The Take Home

The recent Bitcoin halving, consequently, has the potential to alter the Cryptocurrency market drastically. Moreover, Bitcoin continues to be a cornerstone investment with its growing integration into the financial ecosystem and anticipated future valuations, especially with halving events in the picture. Undoubtedly, two strong alternatives to Bitcoin are Ethereum and Polkadot.

These developments in Crypto markets represent the convergence of technology and speculative economic dynamics and serve as a conduit to larger and more sophisticated technological shifts towards digital economies. As the aftermath of Bitcoin’s 2024 halving becomes clear, digital currency investors should pay attention to the three Cryptocurrencies discussed in this write-up.

Image Source: Shutterstock

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used for legal, tax, investment, financial or other advice.