Bitcoin has undoubtedly influenced the financial landscape considerably. Since its launch, the Cryptocurrency has experienced an impressive rise in value, drawing the interest of investors, institutions and governments worldwide.

Nevertheless, due to its swift expansion and extensive adoption, many are questioning whether it is still possible to achieve billionaire status via Bitcoin.

The Initial Days of Bitcoin Fortune

In 2010, Bitcoin was priced at only a few cents, and acquiring thousands demanded little beyond a firm belief in a nascent, unproven technology. Initial investors, such as the Winklevoss twins and venture capitalist Tim Draper, capitalized on this initial chance to maintain their investments amid ongoing impressive Bitcoin growth.

To this date, Bitcoin has transformed from an obscure digital trial into an important financial asset. As its price soared above $100,000 in recent years and its market in the region of $2 trillion, the era of significant, rapid gains could be nigh. However, this does not suggest that Bitcoin’s story or ability to create wealth is finished.

For the typical investor, achieving billionaire status exclusively through Bitcoin investment is unlikely. Here’s why:

Market Maturity

Bitcoin has evolved from a speculative investment into an acknowledged store of value, commonly known as “digital gold.” Although this has lowered its likelihood of failure, it has also decreased its growth potential. It’s still possible for values to double or triple, but the era of achieving 1,000x returns seems to be over.

Institutional Involvement

Major institutional players, from hedge funds to corporations, have entered Bitcoin, bringing significant capital and competition. This has added stability to the market and dampened the wild volatility that once created massive wealth for early participants.

Regulatory Developments

As governments worldwide continue to regulate cryptocurrency markets, Bitcoin’s speculative appeal has been somewhat tempered. Regulatory clarity enhances trust and adoption but reduces the high-risk, high-reward dynamic that characterized its early years.

Can Bitcoin Still Create Wealth?

While achieving billionaire status may be unrealistic, Bitcoin remains a compelling investment for several reasons:

Value in the Long Term

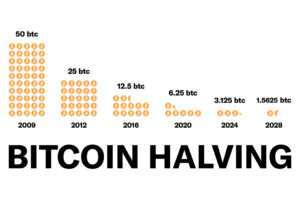

Considering the capped supply of 21 million coins and wider adoption of Bitcoin, the long-term trend may guide its price upwards. Analysts expect long-term growth, vastly improved as Bitcoin takes deeper roots into the financial systems.

Portfolio Diversification

Bitcoin acts as a non-correlated asset and, therefore, a good hedge against inflation and traditional market declines. It could be a great addition to a diversified portfolio for institutional and retail investors.

Opportunities in the Ecosystem

There are avenues for wealth creation through the broader alternative Cryptocurrency and Blockchain; the new technologies, decentralized finance (DeFi), and new Blockchain protocols may show growth opportunities that are similar to those of the early days of Bitcoin.

How Should You Approach Bitcoin in 2025?

If one is to make any sincere investment in Bitcoin in 2025, establishing practical goals and being disciplined about following them is essential. Put away thoughts of instant riches rather than see Bitcoin in a broader light as a genuine, long-term investment with stable value, not as a hedge from potential gains from speculation.

Another successful approach is dollar-cost averaging—investing modest, regular sums over time. This strategy aids in alleviating the impacts of market fluctuations and lessens the emotional strain of attempting to time the market.

Ultimately, remaining knowledgeable is essential. The cryptocurrency environment changes swiftly as technological advancements, regulations, and market dynamics continually influence the sector. Staying current with these developments allows you to make knowledgeable choices and adjust to new chances.

A Fresh Outlook on Building Wealth

Although the chance of becoming a Bitcoin billionaire has drastically dwindled, Cryptocurrency can still allow considerable financial expansion. Bitcoin has evolved into a widely acknowledged asset, providing chances for consistent, long-term wealth growth instead of the remarkable gains seen in its initial phase.

Bitcoin and Blockchain technology are in the initial phases of transforming industries and economies. By engaging with the market through well-informed tactics and achievable objectives, investors can still benefit from this transformative period—though maybe not achieving billionaire status.

Image Source: Adobe Stock

Disclaimer: This article is purely for informational purposes. It is not offered or intended to be used for legal, tax, investment or financial advice.